Gullak App Review: Saving money is one of the best financial habits, but it can be challenging to stay consistent. With rising expenses and fluctuating incomes, many people struggle to set aside savings regularly. This is where savings apps like Gullak come in handy.

By automating the saving process and offering investment options like digital gold, Gullak ensures users can build wealth effortlessly over time. If you’re looking for a hassle-free and secure way to save and grow your money, Gullak might be the perfect app for you.

In this Gullak App Review, we’ll explore how it automates the saving process and offers investment options, such as digital gold, making it easier to build wealth over time. If you’re looking for a hassle-free and secure way to save and grow your money, Gullak might be the perfect app for you.

Must Read – Groww App Review 2025: Simplify Your Investments Today

What is the Gullak App?

Gullak is a savings and investment app that enables users to save small amounts effortlessly and invest in 24K digital gold. The app works by rounding up spare changes from daily UPI transactions and converting them into savings, which can be invested for better returns.

Unlike traditional savings accounts, Gullak offers higher returns and flexible withdrawal options, making it a great alternative for users looking to build long-term wealth. With its Gold+ SIP feature, users can earn additional rewards while ensuring their savings grow steadily.

Gullak App Specifications

| App Name | Gullak |

| Platform | Android & iOS |

| Category | Savings & Investment |

| Investment Type | 24K Digital Gold |

| Security | Backed by Augmont, ICICI Lombard, Razorpay |

| Withdrawal Options | Bank transfer (UPI) or Physical Gold Delivery |

6 Key Features of the Gullak App

Here are six standout features that make the Gullak app a smart choice for effortless savings and investment, as highlighted in this Gullak App Review.

1. Save on Every Spend

Gullak’s ‘Save on Every Spend’ feature helps users save effortlessly by rounding up their daily UPI transactions and investing the spare change in digital gold. This makes saving money an automatic and seamless process without requiring manual effort.

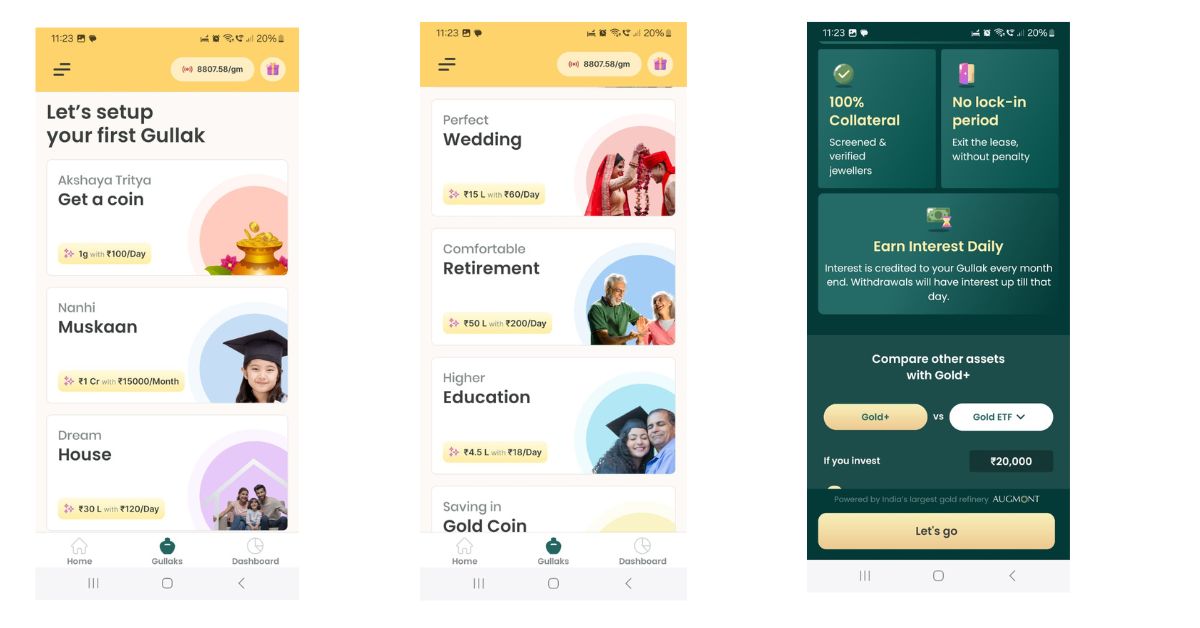

2. Gold+ SIP for Higher Returns

With Gold+ SIP, users can set up a daily Systematic Investment Plan (SIP) through UPI AutoPay and earn up to 11% market returns by leasing gold to trusted jewellers. This ensures higher returns compared to traditional savings accounts or fixed deposits.

3. Flexible Withdrawals & Physical Gold Delivery

Users can withdraw their investments at any time in the form of money (transferred via UPI) or opt for physical gold delivery. This flexibility allows users to use their savings as needed without any restrictions.

4. Goal-Based Savings Plans

Gullak offers customised savings plans based on user goals, such as buying a house, wedding, education, or retirement. With as little as ₹50/day, users can start their savings journey with a structured plan.

5. Refer & Earn Rewards

Users can refer friends and earn up to ₹2000 when they invest in Gullak’s Gold+ SIP. The referred friend also benefits by getting up to ₹1000 when they start investing. This makes the app more rewarding for active users.

6. 100% Secure & Trusted Platform

Gullak is backed by reputed financial institutions like Augmont, ICICI Lombard, and Razorpay, ensuring a safe and secure investment experience. Additionally, every gold purchase is certified, giving users peace of mind about their investments.

Must Read – Google Tez App Review: Is It the Future of Cashless Transactions in India?

Pros & Cons of Gullak App

Here’s a summary of the key advantages and limitations based on our Gullak App Review.

| Gold+ SIP with up to 11% returns | Limited to gold investments only |

| Easy withdrawals (cash or physical gold) | No stock or mutual fund investment options |

| Secure and backed by reputed institutions | |

| Attractive referral and savings rewards |

Final Verdict: Is Gullak Worth Using?

After diving deep into this Gullak App Review, it’s clear that Gullak is an excellent app for those who want to develop a habit of saving money effortlessly and investing in 24K digital gold. With its automated savings, Gold+ SIP with high returns, and flexible withdrawal options, it provides a better alternative to traditional savings methods. If you are a student, a working professional, or someone looking for low-risk investment options, Gullak is a safe, secure, and rewarding app to try.

Must Read – 15 Best Money Earning Apps Without Investment in 2025

Frequently Asked Questions (FAQs): Gullak App Review

Q. What is meant by daily savings?

A. Daily savings means setting aside a small fixed amount daily towards your investment goal. In Gullak, you can start with as little as ₹50/day.

Q. What is the ‘Save on Every Spend’ feature?

A. This feature rounds up your UPI transactions and automatically invests the spare change in digital gold. It helps users save without extra effort.

Q. Can I make a one-time/lump sum investment?

A. Yes, Gullak allows users to invest a lump sum amount in digital gold apart from daily savings.

Q. Is Gullak safe to use?

A. Gullak is backed by Augmont, ICICI Lombard, and Razorpay, ensuring a 100% secure investment experience. Additionally, every gold purchase comes with a certificate of authenticity.

Q. Can I withdraw my money anytime?

A. Users can withdraw their savings anytime via UPI transfer or request physical gold delivery. There are no lock-in periods or penalties.

![Top 7 Crypto Trading Apps for Beginners in 2025 [Updated] Best Crypto Trading Apps for Beginners](https://appruckus.com/wp-content/uploads/2024/10/Best-Crypto-Trading-Apps-for-Beginners.webp)