Managing money can be confusing and stressful, especially with hundreds of options and a plethora of information. People often face challenges like – high fees, complicated processes, and a lack of tools to help them make the right financial decisions. This is where finance apps are useful, as they make it easier to save, invest, and manage money all in one place.

Groww is one of the most popular finance apps in India, and it is trusted by millions of users. It simplifies investing and trading, offering everything from mutual funds to stocks and even gold bonds. In this Groww app review, let’s dive into its offerings and see why it’s a favourite among Indian investors.

What is the Groww App?

Groww is India’s leading stockbroking and investment platform and is trusted by over 10 million active investors. It was launched in 2016 by ex-Flipkart employees and has become a one-stop solution for investing in mutual funds, stocks, IPOs, and Futures & Options (F&O). Groww also supports Sovereign Gold Bonds (SGBs), UPI payments, and even bill recharges. Its beginner-friendly interface and transparent fee structure make it a top choice for both new and experienced investors.

If you’re looking for a Groww app review in Hindi, you’ll find numerous resources online that explain how it works and how to start investing step-by-step.

Must Read – The 8 Best Trading Apps in India From Beginner to Expert

Specifications of Groww App

| Feature | Details |

| Platform | Android, iOS, Web |

| OS Requirement | Android 6.0 and iOS 13.0 or higher |

| Developer | NextBillion Technology Pvt. Ltd |

| Installs | 10+ Million |

| Last Update | Regularly Updated |

| File Size | Varies by Device and Platform |

Key Features of the Groww App

The Groww app for Android is packed with features designed to make investing and managing finances effortless for users. From mutual funds and stocks to advanced trading options and gold bonds, Groww offers a wide range of tools to meet the needs of every investor. Its simple interface, affordable pricing, and robust security ensure a smooth and secure experience. Here’s a closer look at the key features that make Groww one of India’s most trusted finance apps.

1. Free Demat Account

Groww offers a free Demat account with no annual maintenance charges (AMC) for a lifetime. This makes it easy for beginners to start investing without worrying about upfront costs or hidden fees.

2. Transparent Brokerage Fees

Users benefit from a flat ₹20 brokerage fee per trade across intraday, delivery, and F&O. Mutual fund investments are completely free.

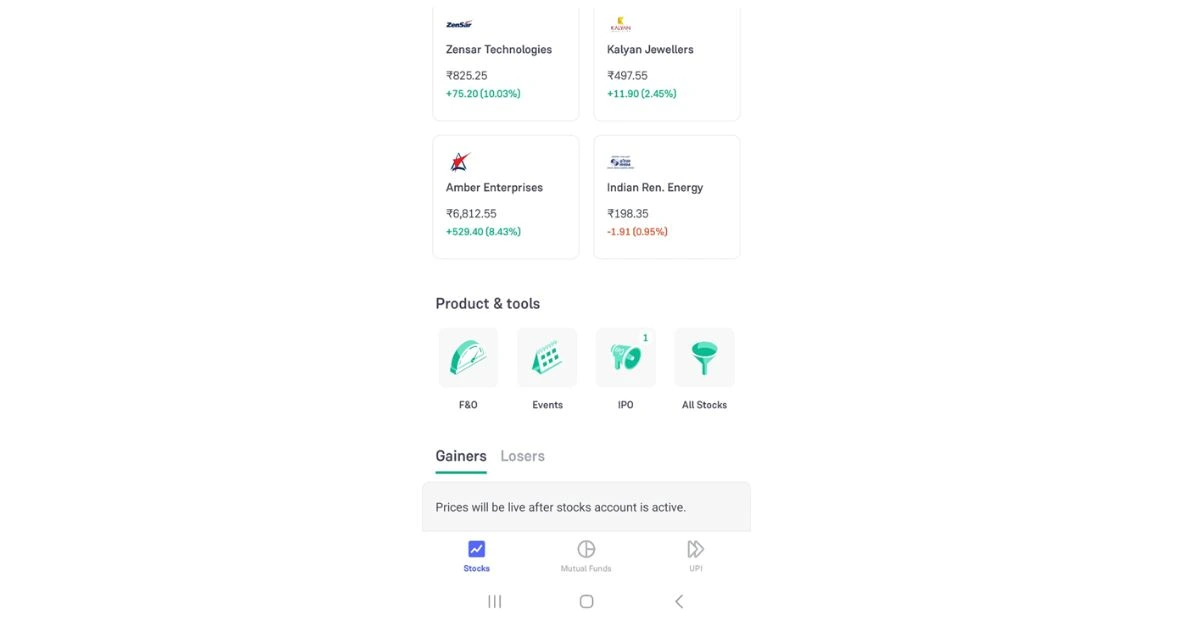

3. Seamless Stock Market Integration

Groww provides access to stocks listed on the NSE and BSE. Users can trade, monitor stock indices like NIFTY and SENSEX, and even apply for IPOs like Swiggy or Bajaj Housing Finance through the app. It has advanced tools like GTT orders, TradingView charts, and stock screeners, which make the platform suitable for informed trading decisions.

4. Futures & Options Trading

Groww simplifies F&O trading with features like Option Chain, Basket Orders, and Safe Exit. Users can access advanced charts and trade efficiently using customised strategies.

Must Read – Top 7 Crypto Trading Apps for Beginners in 2025

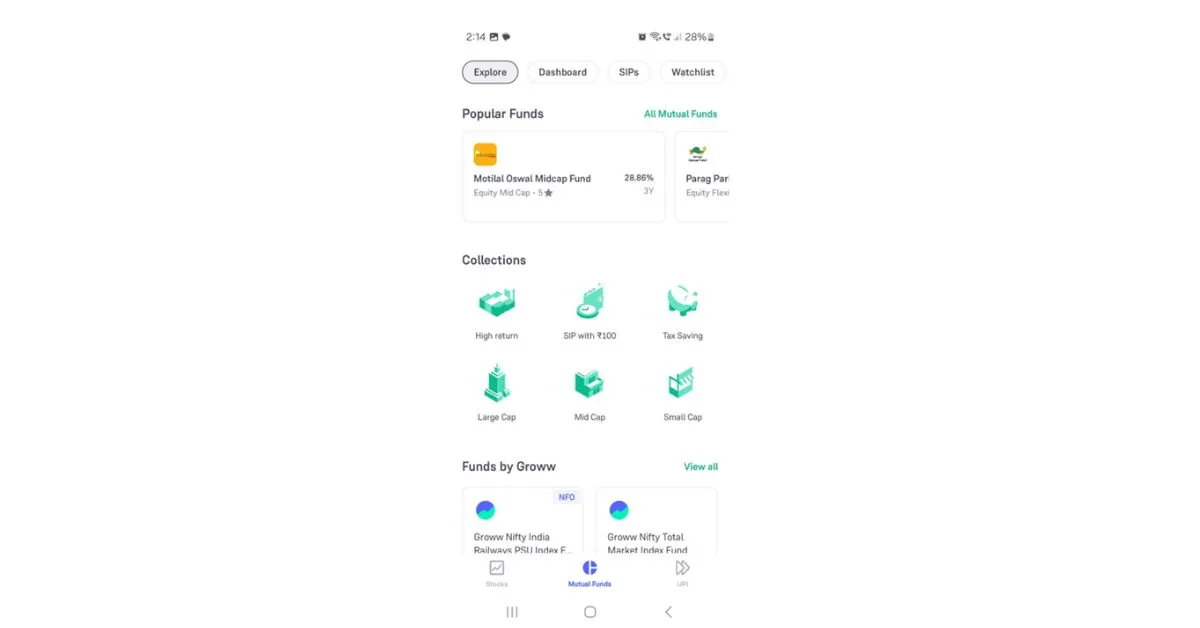

5. Direct Mutual Fund Investment

With over 5,000 mutual funds to choose from, Groww supports direct mutual fund investments with zero commission. It also offers SIP calculators and tools to manage your portfolio effectively. If you’re looking for a detailed Groww mutual fund app review, this feature is one of its biggest highlights.

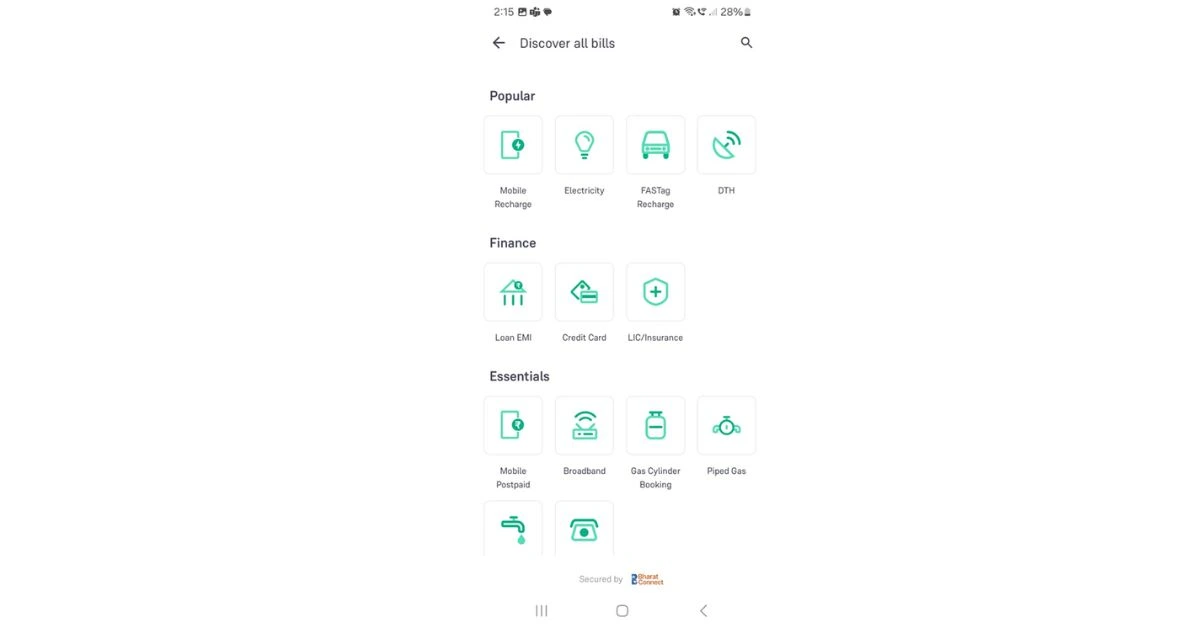

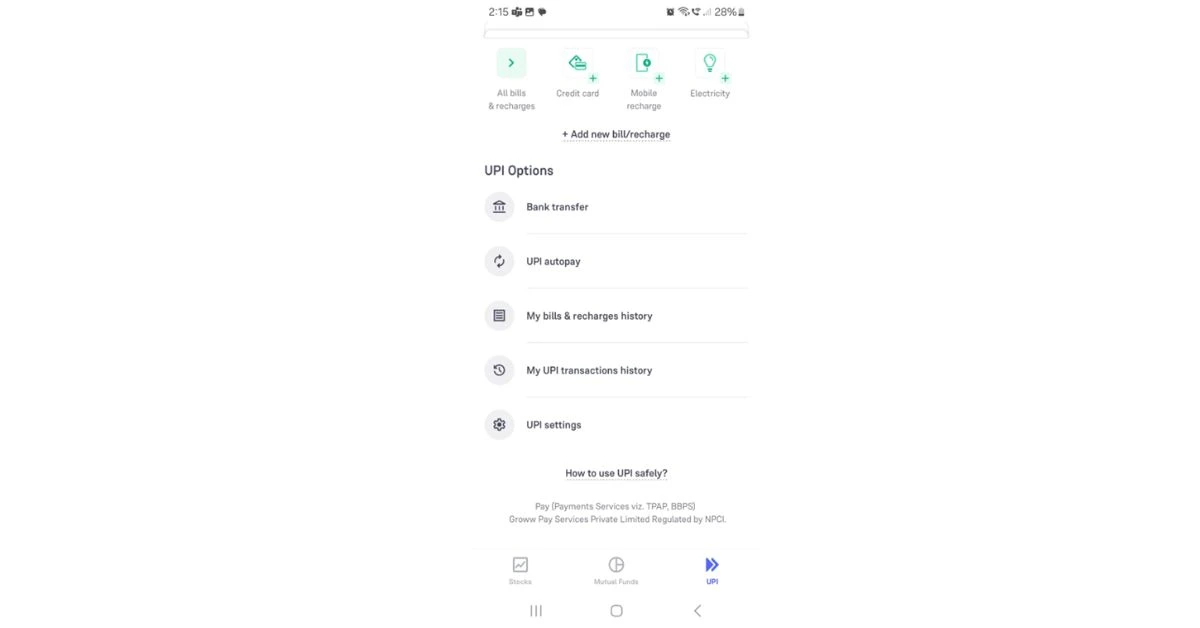

6. UPI Payments and Bill Recharges

Groww doubles as a UPI payment platform, enabling users to send money, pay bills, recharge FASTag, and manage finances seamlessly.

7. Secure Platform

Groww keeps your transactions safe and secure by using advanced 128-bit SSL encryption to protect your data and biometric authentication, like fingerprint or face recognition, to confirm your identity.

Must Read – Google Tez App Review: Is It the Future of Cashless Transactions in India?

Pros and Cons of the Groww App

| Pros | Cons |

| Free Demat account with zero AMC | No desktop trading platform |

| Flat ₹20 brokerage fee across trades | Limited advanced tools for pro traders |

| User-friendly interface | Requires internet connectivity |

| Robust security features | |

| Wide range of investment options |

Final Thoughts: About Groww App

The Groww app for iOS and Android has redefined the way Indians invest and trade. Its beginner-friendly interface, free Demat account, and transparent pricing make it one of the most popular platforms in the country. The app empowers users to make informed financial decisions with tools like advanced charts, stock screeners, and real-time market updates.

If you’re new to investing or looking for a hassle-free experience, Groww is an excellent choice.

FAQs: Groww App Review

Q. Is Groww free to use?

A. Yes, opening a Demat account and investing in mutual funds on Groww is free. However, there is a flat ₹20 fee per trade for stocks and F&O.

Q. How secure is the Groww app?

A. Groww uses 128-bit SSL encryption and biometric authentication, ensuring all transactions are secure and protected.

Q. Can I trade in Futures & Options (F&O) on Groww?

A. Yes, Groww supports F&O trading with tools like Option Chain, Basket Orders, and TradingView charts for informed decision-making.

Q. What makes Groww different from other brokers?

A. Groww offers zero account opening charges, no AMC, and free mutual fund investments, combined with a user-friendly app and web platform.

Q. Can I switch mutual funds on Groww?

A. Yes, Groww allows you to switch external regular mutual funds to direct funds easily, enabling higher returns.

Q. Is Groww suitable for beginners?

A. Absolutely. Groww’s intuitive interface, transparent pricing, and customer support make it a great choice for beginners.

![Top 7 Crypto Trading Apps for Beginners in 2025 [Updated] Best Crypto Trading Apps for Beginners](https://appruckus.com/wp-content/uploads/2024/10/Best-Crypto-Trading-Apps-for-Beginners.webp)